Let’s dive straight into the heart of online entrepreneurship in the UAE. If you’re looking for the best digital products to sell in 2026, this guide is packed with ideas, investment tips, and local insights. UAE is booming with opportunities, and if you ride the wave now, you could be sitting on your next big success story by the end of the year.

Why Digital Products Are the Future in UAE ?

Selling digital products isn’t just a trend anymore — it’s becoming the backbone of the UAE’s online business landscape. Here’s the deal :

Booming E-commerce Ecosystem

E-commerce in the UAE has grown exponentially, hitting $10 billion in 2024 and projected to cross $30 billion by 2035 ! Digital products ride this growth naturally because they’re easy to deliver, don’t require storage, and are highly scalable. Plus, thanks to the UAE’s “Dubai Digital Economy Strategy,” startups are getting even more incentives.

Government Support for Digital Businesses

The UAE government actively supports the digital economy. Initiatives like Dubai Future Accelerators, Abu Dhabi’s Hub71, and “NextGenFDI” are inviting entrepreneurs to build innovative digital solutions. This low-entry barrier combined with heavy government backing makes selling digital products not just easy but super profitable.

Rising Mobile and Internet Penetration

UAE has an insane mobile penetration rate (over 99%) and one of the fastest internet connections globally. With people glued to their screens, selling digital products that solve specific problems is a golden ticket to success.

Essential Tips Before Selling Digital Products in UAE

Before you jump headfirst into the digital market, hold up ! Let’s cover a few UAE-specific essentials first.

Understanding VAT and Regulations

Digital products are subject to 5% VAT in the UAE, and if your annual turnover crosses AED 375,000, you MUST register for VAT. Make sure to issue proper invoices and stay compliant. Setting up a freelance license in Dubai (costs roughly AED 7,500 annually) can make your business 100% legal and future-proof.

Pro Tip: Use platforms like Creative971 or Virtuzone to simplify business registration.

Market Research and Localization

One big mistake newbies make? Ignoring localization. The UAE is multicultural, but Arabic-first content performs way better for local audiences. Add Arabic translations, accept local payment gateways (Tabby, Tamara), and consider UAE culture in your marketing.

Pro Tip : Conduct small surveys through Instagram polls or local Facebook groups like “Dubai Business Women” before launching your product.

24 Best Digital Products to Sell in UAE (2026)

1. AI-Powered Business Tools (Chatbots, Automation Scripts)

AI is exploding in the UAE, especially for customer service automation. Businesses in Dubai & Abu Dhabi desperately need AI chatbots (for WhatsApp, websites, and social media) to handle inquiries 24/7.

Why It Works ?

- High demand – UAE SMEs hate missing leads.

- Recurring revenue – Charge monthly subscriptions (Aed50-Aed300).

- Low competition – Few providers offer Arabic-speaking AI.

Investment : Max Aed2000-Aed5000 (ManyChat, Botpress, or custom GPT-4 scripts).

ROI in 1 Year: 300-500% (5-10 clients = Aed3K-Aed10K/year).

Pro Tip: Offer a “Done-For-You” setup (+Aed500 one-time fee).

2. Arabic-Language Online Courses (Coding, Marketing, Finance)

UAE professionals crave upskilling, but 90% of courses are in English. If you create high-quality Arabic courses (video + PDFs), you’ll dominate a massive gap.

Best-Selling Topics:

– “Python for Beginners (Arabic)”

– “Digital Marketing for UAE Entrepreneurs”

– “Day Trading for Gulf Investors”

Investment: Aed1000-Aed3000 (Teachable/Kajabi + Canva).

ROI in 1 Year: 400%+ (Sell at Aed50-Aed200 per course).

Pro Tip: Run LinkedIn ads targeting Arabic-speaking professionals.

3. Custom ChatGPT Prompts for UAE Industries

Most ChatGPT prompts suck for local businesses. You can sell specialized prompt packs like:

- “50 Real Estate Sales Scripts for Dubai Agents”

- “Legal ChatGPT Prompts for UAE Lawyers”

- “Arabic Social Media Post Generator”

Why It Works ?

- Zero overhead – Just a PDF or Notion template.

- Scalable – Sell the same prompts 1000x.

Investment: Aed 0 (just time +skill+ ChatGPT testing).

ROI in 1 Year: 1000%+ (Charge Aed150-Aed800 per pack).

Pro Tip: Offer free samples on LinkedIn to attract B2B buyers.

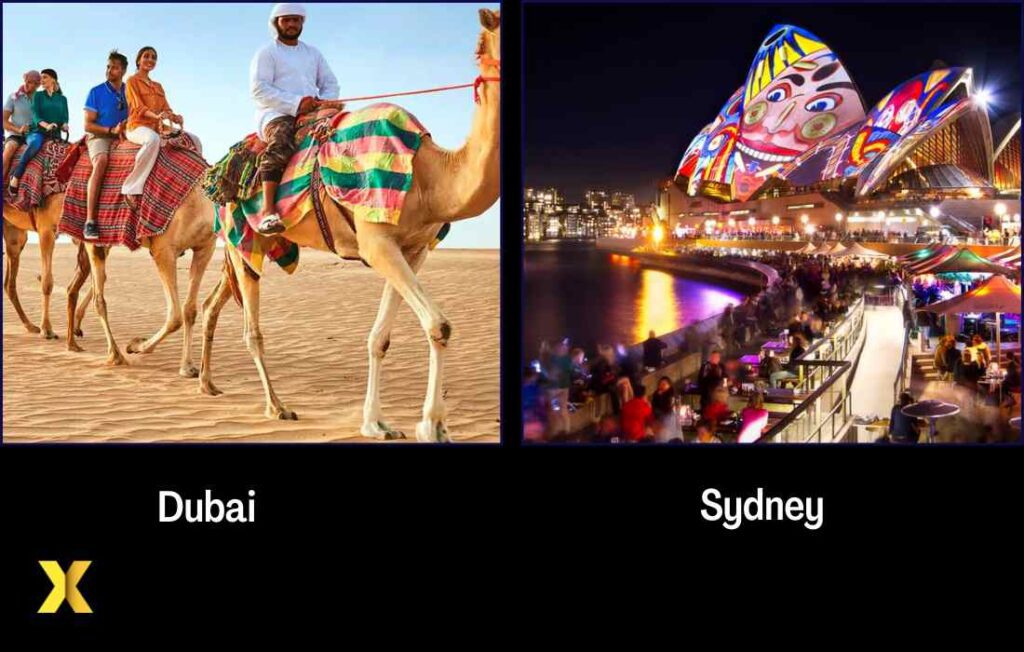

4. Dubai & Abu Dhabi Travel Planners (Digital Guides)

Tourists overpay for generic travel blogs. Instead, sell hyper-local digital guides like:

– “Luxury Dubai Itinerary (2026)”

– “Abu Dhabi Hidden Gems – Local’s Guide”

Why It Works ?

- Evergreen demand – 20M+ tourists visit yearly.

- Easy to create – Use Canva + ChatGPT research.

Investment: Aed500 (Canva Pro + SEO research).

ROI in 1 Year: 500%+ (Sell at Aed100-Aed500 per guide).

Pro Tip: Partner with travel YouTubers for affiliate sales.

5. UAE Stock & Crypto Research Reports

Gulf investors obsess over stocks & crypto but lack local insights. Sell monthly reports like:

– “Top UAE Stocks to Watch (2026)”

– “Dubai Crypto Tax Guide”

Why It Works ?

- Recurring revenue – Charge Aed20-Aed100/month.

- Low effort – Just curate data (no original research needed).

Investment: Aed1000 (Paywall setup + TradingView subscription).

ROI in 1 Year: 800%+ (100 subscribers = Aed5K/month).

Pro Tip: Share free snippets on UAE investing forums.

6. Arabic Resume & LinkedIn Profile Templates

Thousands of UAE job seekers need ATS-friendly resumes in Arabic/English. Sell editable templates (Word/Canva).

Why It Works ?

- High volume – UAE has 2M+ job seekers yearly.

- Easy to scale – One template = unlimited sales.

Investment: Aed100 (Canva templates).

ROI in 1 Year: 1000%+ (Sell at Aed100-Aed150 per template).

Pro Tip: Run Instagram ads targeting Dubai professionals.

7. UAE Business License & Visa Setup Guides

Expats struggle with UAE paperwork. Sell a step-by-step guide like:

– “How to Get a Dubai Freelance Visa (2026)”

– “Free Zone Company Setup Checklist”

Why It Works ?

- Pain point solution – Saves buyers hours of hassle.

- Evergreen – Visa rules change often (update & resell).

Investment: Aed200 (Google Docs + SEO research).

ROI in 1 Year: 600%+ (Charge Aed 300-Aed 500 per guide).

Pro Tip: Rank for “UAE freelance visa 2026” (low competition).

8. Arabic eBooks (Self-Help, Business, Fiction)

The UAE lacks high-quality Arabic eBooks. Publish on Amazon KDP or your own site.

Best-Selling Niches:

– “How to Start a Business in Dubai”

– “Islamic Finance for Beginners”

Investment: Aed 500 (Hire a writer from Upwork).

ROI in 1 Year: 300%+ (Earn Aed 50-Aed 100 per eBook).

Pro Tip: Use AI translation tools to convert English books to Arabic.

9. UAE Social Media Templates (Instagram, TikTok)

Dubai influencers & brands need trendy Reels/TikTok templates. Sell Canva templates for:

– “Luxury Brand Instagram Posts”

– “Dubai Foodie TikTok Templates”

Why It Works?

Trend-driven – Templates go viral fast.

Passive income – Sell the same pack 1000x.

Investment: Aed 150(Canva Pro).

ROI in 1 Year: 900% + (Charge Aed150-Aed 500 per pack).

Pro Tip: Offer “Custom Branding Add-On” (+Aed50).

10. UAE Virtual Events (Webinars, Workshops)

Host paid Zoom workshops on trending topics like:

– “How to Invest in Dubai Real Estate (2026)”

– “E-Commerce Masterclass for UAE Sellers”

Why It Works?

- High-ticket sales – Charge Aed50-Aed500 per ticket.

- Upsell opportunities – Offer 1:1 coaching later.

Investment: Aed0 (just Zoom + LinkedIn promotion).

ROI in 1 Year: 1000%+ (100 attendees = Aed5K-Aed50K).

Pro Tip: Record & sell replays as a course.

11. UAE Property Investment Calculators (Excel/Web App)

Real estate investors in Dubai & Abu Dhabi need instant ROI calculations for properties. Sell a custom Excel sheet or web app that auto-calculates:

- Rental yields

- Mortgage payments

- ROI based on location

Why It Works?

– High perceived value – Investors pay Aed 200-Aed400 for this.

– Recurring sales – Update yearly with new market rates.

Investment: Aed100 (Excel/Google Sheets template).

ROI in 1 Year: 500%+ (Sell 100+ copies at Aed200 each).

Pro Tip: Offer a “Done-For-You Customization” upsell (+ Aed 450).

12. Arabic Podcast Production Services

UAE brands & influencers struggle to launch Arabic podcasts. Offer full-service production:

- Scriptwriting

- Editing

- Voiceover (hire freelancers)

Why It Works?

– Booming podcast market – UAE listens to 3x more Arabic content.

– High-ticket service – Charge Aed500-Aed2,000 per episode.

Investment: Aed 1000 (Mic + editing software).

ROI in 1 Year: 1000%+ (10 clients = Aed10K-Aed20K).

Pro Tip: Pitch Dubai-based entrepreneurs via LinkedIn.

13. UAE Influencer Media Kits (Canva Templates)

Dubai influencers need sleek media kits to attract brands. Sell editable Canva templates tailored for:

- Fashion bloggers

- Food reviewers

- Travel influencers

Why It Works?

– Low effort, high demand – 1,000+ influencers in Dubai alone.

– Scalable – Same template = unlimited sales.

Investment: Aed150 (Canva Pro)

ROI in 1 Year: 1500%+ (Sell 200+ kits at Aed100 each)

Pro Tip: Run Instagram story ads targeting UAE influencers

14. AI-Generated Arabic Content (Blogs/Social Media)

UAE businesses hate writing Arabic posts. Sell AI-generated content (using tools like Jasper AI + human editing).

Best-Selling Packages:

- 30 Instagram captions (Arabic) – Aed100

- 10 SEO blog posts – Aed300

Why It Works?

– Time-saving for businesses.

– Recurring clients (monthly content plans).

Investment: Aed50 (AI tool subscription).

ROI in 1 Year: 800%+ (20 clients = Aed10K/year).

Pro Tip: Offer “SEO Optimization” as an add-on (+Aed100 /post).

15. UAE Local SEO Reports for Small Businesses

Dubai shops & restaurants don’t rank on Google Maps. Sell local SEO audits (Aed200-Aed500) that:

- Fix Google My Business listings

- Generate 5-star reviews

- Optimize for “near me” searches

Why It Works ?

– Massive demand – 90% of UAE searches are local.

– Recurring revenue – Offer monthly maintenance.

Investment: Aed0 (free SEO tools like BrightLocal).

ROI in 1 Year: 1000%+ (50 audits = Aed10K-Aed25K).

Pro Tip: Cold email Dubai salons & gyms (they NEED this).

16. Arabic Children’s eBooks (Amazon KDP)

UAE parents crave Arabic kids’ books but find low-quality options. Publish:

- Islamic bedtime stories

- Arabic alphabet books

- Bilingual (Arabic-English) books

Why It Works ?

– Evergreen niche – Parents always buy kids’ books.

– Passive income – Sell 24/7 on Amazon.

Investment: Aed 400 (Illustrator + writer).

ROI in 1 Year: 400%+ (Earn Aed100-Aed150 per book).

Pro Tip: Use AI illustration tools (MidJourney) to cut costs.

17. UAE Freelancer Contracts (Legal Templates)

Dubai freelancers get scammed without proper contracts. Sell UAE-legal templates for:

- Graphic designers

- Social media managers

- Consultants

Why It Works ?

– Pain point solution – Freelancers fear non-payment.

– Scalable – Sell same template 1,000x.

Investment: Aed100 (Lawyer review).

ROI in 1 Year: 1000%+ (Sell 500+ at Aed 100 each).

Pro Tip: Partner with Dubai freelance Facebook groups.

18. Arabic YouTube Scriptwriting Services

UAE YouTubers struggle with Arabic scripts. Offer engaging video scripts for:

- Tech reviewers

- Islamic content creators

- Business channels

Why It Works ?

– High demand, low competition.

– Charge Aed50-Aed200 per script.

Investment: Aed 0 (Just research + writing).

ROI in 1 Year: 1200%+ (100 scripts = Aed5K-Aed20K).

Pro Tip: Upsell “Video Editing” services.

19. UAE Car Import/Export Guides (Digital PDF)

Expats overpay to import cars to Dubai. Sell a step-by-step guide covering:

- Customs duties

- Best deals in Japan/Germany

- UAE registration process

Why It Works ?

– High-ticket buyers – Charge Aed50-Aed100 per guide.

– Recurring updates – Laws change yearly.

Investment: Aed 150 (Research + Canva).

ROI in 1 Year: 800%+ (Sell 200+ copies).

Pro Tip: Run Facebook ads targeting expat car groups.

20. AI-Generated Arabic Voiceovers (Text-to-Speech)

UAE businesses need Arabic voiceovers for ads & videos. Use AI tools like Murf.ai to generate human-like voices.

Why It Works ?

– 80% cheaper than hiring voice actors.

– Charge Aed20-Aed100 per audio file.

Investment: Aed 90/month (AI tool).

ROI in 1 Year: 1500%+ (100 voiceovers = Aed2K-Aed10K).

Pro Tip: Offer “Urgent 24-Hour Delivery” (+50% fee).

21. UAE-Specific Notion Templates (Productivity & Business)

Sell pre-made Notion templates for:

- Dubai real estate investors

- UAE freelancers (tax tracking)

- Ramadan meal planners

Why It Works ?

– Trendy & passive – Sell same template forever.

– Charge Aed 150-Aed200 per template.

Investment: Aed 0 (Notion free plan).

ROI in 1 Year: 2000%+ (500 sales = Aed7.5K-Aed25K).

Pro Tip: Share free samples in UAE productivity Facebook groups.

22. Arabic-Subtitled Video Courses (Udemy Skillshare)

Buy popular English courses, add Arabic subtitles, and resell on Udemy/Skillshare.

Why It Works ?

– Zero content creation – Just translation.

– Passive income – Earn Aed 50-Aed 150 per sale.

Investment: Aed 200 (Freelance subtitler).

ROI in 1 Year: 500%+ (500 sales = Aed5K-Aed25K).

Pro Tip: Focus on tech & business courses (high demand).

23. UAE Virtual Assistant Directory (Paid Membership)

Create a paid directory where UAE businesses find pre-vetted virtual assistants.

Why It Works ?

– Recurring revenue – Charge Aed20/month for access.

– High demand – UAE startups love outsourcing.

Investment: Aed1000 (Website + WhatsApp automation).

ROI in 1 Year: 1000%+ (200 members = Aed14K/year).

Pro Tip: Offer “7-Day Free Trial” to convert leads.

24. Dubai Event Photography Presets (Lightroom/VSCO)

Sell custom photo filters for:

- Luxury Dubai weddings

- Desert photoshoots

- Instagram influencers

Why It Works ?

– One-time creation, forever sales.

– Charge Aed100-Aed500 per preset pack.

Investment: Aed0 (Free Lightroom mobile app).

ROI in 1 Year: 3000%+ (1,000 sales = Aed10K-Aed50K).

Pro Tip: Give free samples to Dubai photographers for testimonials.

Conclusion :Which One Will YOU Launch?

The UAE digital market is exploding—pick a product, validate demand (use Facebook groups & LinkedIn polls), and start small.

Best for beginners? → Notion templates (Aed0 investment).

Best for quick cash? → AI voiceovers (Aed300 startup).

Best for passive income? → Amazon KDP eBooks.

Which idea excites you most ? Let me know in the comments !