Dubai : Awe-inspiring skyline, luxurious hotels & vibrant cultural scene, has attracted chinese tourist from quite long and now it has become a favorite destination for chinese tourists worldwide.

Chinese travelers hold a special place, drawn to Dubai’s unique blend of modernity and tradition.

In fact, China is now the second-largest source of tourists to Dubai, after the United Kingdom.

In this blog article, we will explore 15 reasons why Chinese tourists love to visit Dubai, along with some top places they often frequent and activities they enjoy during their stay.

20 Reasons why chinese tourist likes to visit Dubai

1. Modern Architecture and Landmarks

Dubai is renowned for its iconic modern architecture, featuring structures like the Burj Khalifa, the world’s tallest building. Chinese tourists are fascinated by these awe-inspiring landmarks, which provide excellent photo opportunities and content creators.

We have seen many chinese content creators to specially come to dubai for explorataion.

2. Luxurious Shopping Experience

Dubai is a shopping paradise, and Chinese tourists, known for their love of luxury brands, flock to the city’s high-end malls like the Dubai Mall and Mall of the Emirates to indulge in shopping sprees.

Dubai is home to some of the world’s best shopping malls, including the Dubai Mall, which is the largest shopping mall in the world. Chinese tourists love to shop, and they find Dubai to be a shopper’s paradise.

3. Safety & Security

Dubai has a very low crime rate, and it is considered to be one of the safest cities in the world. This is important to Chinese tourists, who are often concerned about safety when traveling abroad.

4. Cultural Diversity

Dubai is a melting pot of cultures, and Chinese tourists appreciate the opportunity to experience a wide range of international cuisines and traditions.

It offers a wide variety of things to see and do. Chinese tourists appreciate the city’s blend of traditional and modern, and they enjoy exploring all that Dubai has to offer.

5. Year-Round Sunshine

Chinese tourists, especially those from colder regions, cherish Dubai’s year-round sunshine and warm weather, making it an ideal escape during winter months.

Dubai has a great hot desert climate, but it is also very sunny and dry. This makes it a great place to escape the cold winters of China.

6. Adventure and Thrills

Dubai offers numerous adventure activities, such as desert safaris, dune bashing, and skydiving, appealing to the adventurous spirit of Chinese travelers.

7. Luxurious Accommodation

Dubai boasts a plethora of luxurious hotels and resorts, providing Chinese tourists with opulent experiences and world-class hospitality.

Chinese loves to experience the luxury provided by Dubai like burj al arab,armni hotal,Atlantis and many other palm jumierah hotels.

8. Global Events,Exhibitions & Business opportunity

Dubai is a major business hub where it hosts various international events and exhibitions, attracting Chinese tourists interested in business networking and exploring new opportunities.

World Trade centre,Dubai also hosts chinese expo trade for the business opportunities.

Dubai is a great place to do business and it offers a number of opportunities for Chinese businesses. Chinese tourists often come to Dubai to meet with business partners, attend conferences, or conduct research.

9. Cultural Heritage

Dubai is a great place to experience Arab culture. Dubai is a Muslim country, and it offers a unique opportunity to experience Arab culture. Chinese tourists are often interested in learning more about Arab culture, and they find Dubai to be a great place to do so.

While Dubai is known for its modernity, it also offers a glimpse into its rich cultural heritage through attractions like the Dubai Museum and traditional souks.

10. Theme Parks and Family Entertainment

Families from China enjoy visiting Dubai’s world-class theme parks like Dubai Parks and Resorts, providing entertainment for all age groups.

Dubai has a lot of family-friendly attractions including the Dubai Miracle Garden, the Dubai Aquarium and Underwater Zoo, and the Legoland Dubai. Chinese tourists often travel with their families, and they appreciate Dubai’s many kid-friendly options.

11. Ease of Connectivity

With multiple direct flights connecting Dubai to major Chinese cities, accessibility has become more convenient, encouraging more Chinese tourists to visit.

12. Futuristic Technology

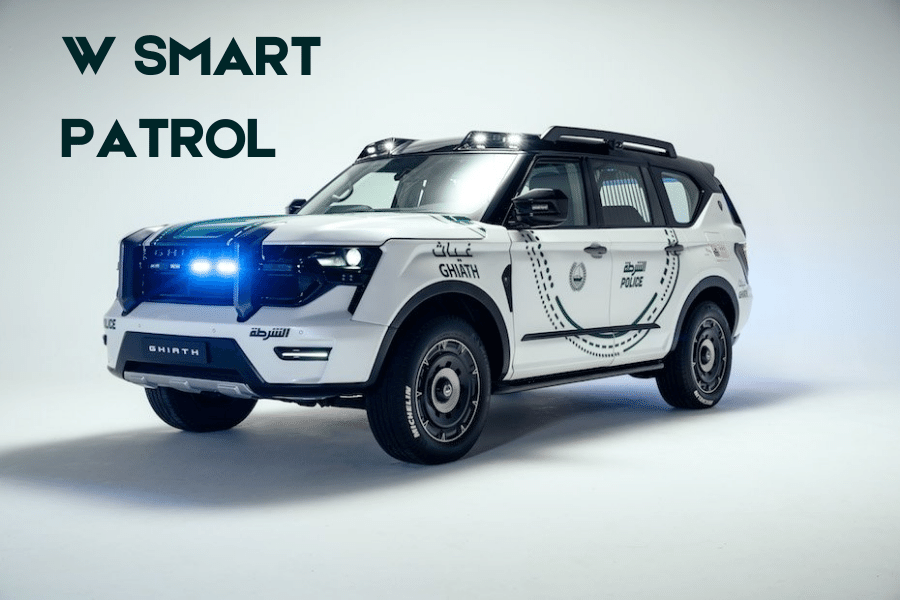

Chinese tourists are intrigued by Dubai’s integration of futuristic technologies, such as AI-powered police officers and autonomous transport.

13. Extravagant Dining Experiences

Dubai has a great variety of restaurants serving everything from traditional Emirati cuisine to international fare.

Chinese tourists appreciate the city’s diverse dining options,from fine dining restaurants to unique food trucks, catering to diverse palates.and they often enjoy trying new foods when they visit Dubai.

14. Mesmerizing Desert Landscape

Dubai is located in the desert, and it offers a number of opportunities to experience the desert. Chinese tourists often enjoy camel rides, desert safaris, and sandboarding in the desert.

The desert landscape surrounding Dubai provides a unique experience for Chinese tourists, who can partake in desert activities like camel rides and sandboarding.

15. Hospitality and Warmth

Dubai’s hospitality industry is known for its warmth and attentiveness, creating a welcoming environment for Chinese tourists.

16. Opulent Yacht Cruises

Chinese tourists with a taste for luxury can indulge in yacht cruises along Dubai’s picturesque coastline, enjoying the breathtaking views of the city’s skyline.

17. Relax & Unwind

Dubai has a number of spas and resorts where Chinese tourists can relax and pamper themselves. Chinese tourists often find Dubai to be a very relaxing place, and they enjoy taking advantage of the city’s many spa and resort options.

18. Festive and Party Hub

Dubai has a vibrant nightlife scene, and it is a great place to party. Chinese tourists often enjoy the city’s many nightclubs and bars.

Dubai has a number of festive events during the holidays, including Christmas, New Year’s Eve, and Chinese New Year. Chinese tourists often choose to visit Dubai during the holidays to experience the city’s festive atmosphere.

19. Destination Wedding

Dubai is a popular destination for weddings, and it offers a number of wedding venues that cater to Chinese couples. Chinese tourists often choose to get married in Dubai because of the city’s stunning views, luxurious hotels, and excellent service.

20. Learning English

English is the lingua franca of Dubai, and it is a great place to learn English. Chinese tourists who are interested in learning English often come to Dubai to take English classes.

Read This Also : Giant Hummer Dubai sheikh : Full details Revealed

Giant Barbie Doll Dubai near burj khalifa : Is it Fake or Real ?

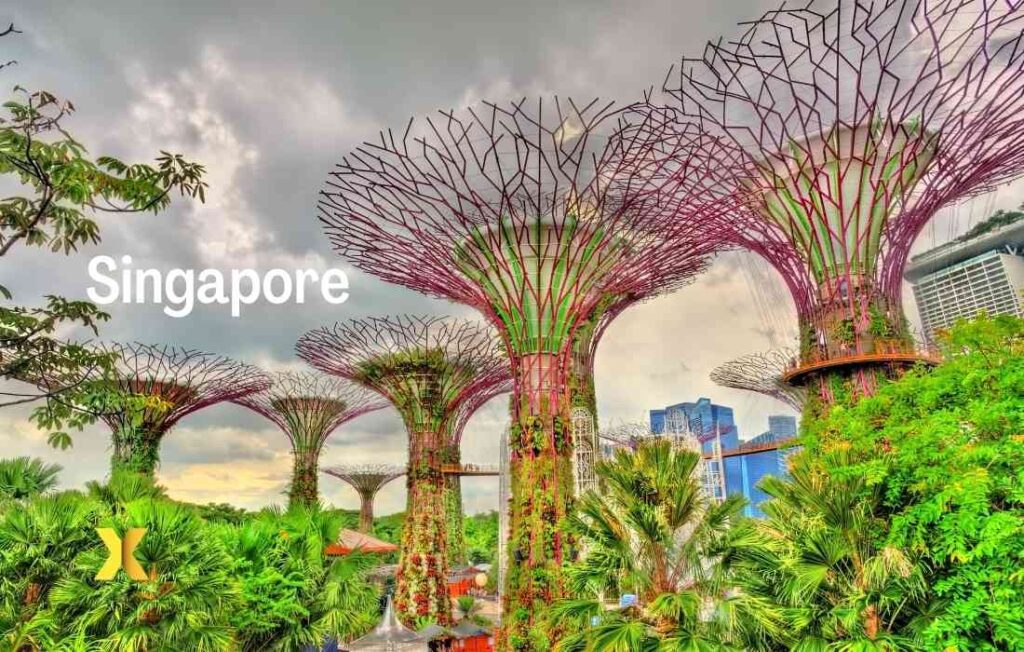

Dubai vs Singapore 2023 : Which one better for You ?

Top Places and Activities for Chinese Tourists

Burj Khalifa: Chinese tourists often visit the iconic Burj Khalifa and experience the breathtaking view from its observation deck.

Dubai Fountain Show: The mesmerizing fountain show outside the Dubai Mall attracts Chinese visitors who marvel at the synchronized water display.

Palm Jumeirah: Chinese tourists love exploring the man-made Palm Jumeirah island, known for its luxury hotels and beachfront resorts.

Global Village: This cultural and entertainment destination offers Chinese tourists a chance to experience diverse cultures from around the world.

Dubai Marina: Chinese travelers enjoy strolling along the picturesque Dubai Marina, dotted with cafes and restaurants.

Dubai Frame: The Dubai Frame offers a unique perspective of the city’s past and future, making it a popular spot for Chinese tourists.

Jumeirah Beach: Chinese tourists relax on the pristine Jumeirah Beach and take part in various water sports.

Gold Souk: Chinese tourists love exploring the bustling Gold Souk, famous for its dazzling display of gold jewelry and ornaments.

Dubai Miracle Garden: Chinese families visit this stunning garden filled with vibrant flowers and intricate sculptures.

IMG Worlds of Adventure: Chinese tourists with families often spend a day at this massive indoor theme park, offering various entertainment options.

Conclusion

Dubai’s allure for Chinese tourists lies in its seamless blend of tradition and modernity, offering a wide range of experiences for every type of traveler.

From its towering skyscrapers to its warm hospitality and cultural diversity, Dubai continues to captivate the hearts of Chinese visitors. Whether they seek luxury, adventure, or cultural exploration, Dubai provides an unforgettable experience for every Chinese tourist.

Dubai is a great place to return to and a city that you never forget, and many Chinese tourists return to Dubai again and again. They love the city’s unique blend of old and new, its vibrant culture, and its endless possibilities.

So what Are you waiting for !

Pack your bags and land up in the jewel of MIDDLE EAST.

Until then,

Be healthy and stay safe.Thank you

Keep following #dxbify Blogs.