Want to buy New Gadget,car,dress,or anything in UAE but you don’t have money for it ?

Don’t be embarrased,we all have been there sometime.

Either it will be New Iphone payment buying from dubai mall or new House rent in dubai marina ,everything could have been transformed into small breakdown payment and now you know what we are talking about.

Are you the budgeted ones in UAE ,who are always looking for some time to pay for full payment ?

Don’t sweat it, friend !

The answer to all your questions and worries is Cheap low cost EMI CREDIT CARDS in Dubai

Imagine this : you’re back from Bali, basking in the glow of sun-kissed skin and island memories. But that new surfboard whispers, “Remember me ?

And the hefty price tag ?” No need to dive into financial panic !

With an EMI card, that board (or any other splurge) can be spread across comfy monthly payments, turning your post-trip blues into “payday with a smile” kind of vibes. Think of it as your financial surfboard, keeping you afloat in the sea of post-vacation expenses.

What is EMI Credit cards ?

An EMI credit card in the UAE, or anywhere else for that matter, is a credit card that allows you to pay for your purchases in Equated Monthly Installments (EMIs).

This means instead of paying the entire amount at once, you can spread it out over a predetermined period, typically ranging from 3 to 24 months, depending on the card and the purchase amount.

How does EMI Credit card works in UAE

Make a purchase: Use your EMI credit card to make a purchase that meets the minimum eligible amount (usually around AED 3,000).

Choose your EMI plan : Select the desired EMI tenure at the checkout or through your card’s online portal.

Monthly repayments: The purchase amount is divided into equal monthly installments that you pay along with your regular credit card statement.

Interest and fees : Most EMI credit cards charge interest on the outstanding balance, though some may offer 0% interest for specific categories or limited periods. There may also be processing fees or other charges associated with using the EMI option.

Benefits of EMI credit cards

Manage large purchases : Allows you to afford bigger purchases like electronics, furniture, or even travel packages without straining your budget.

Flexibility: Choose an EMI plan that suits your repayment capacity and financial situation.

Budgeting tool : Makes budgeting easier by breaking down the cost into predictable monthly payments.

Reward points : Some EMI cards offer reward points or cashback on purchases, even when paid in installments.

Things to consider before using an EMI credit card

Interest rates : Compare interest rates across different cards to find the best deal and avoid high financing charges.

Eligibility : Check the minimum transaction amount and other eligibility criteria for using the EMI option on your card.

Debt accumulation : Don’t overspend just because you have the EMI option. Be mindful of your overall debt and spending habits.

Fees : Watch out for processing fees, late payment charges, or other potential costs associated with EMI usage.

These above points and explianation are not limited ,they can vary according to your needs ,however,basic general principle applies to all emi credit cards while applying or choosing them in UAE.

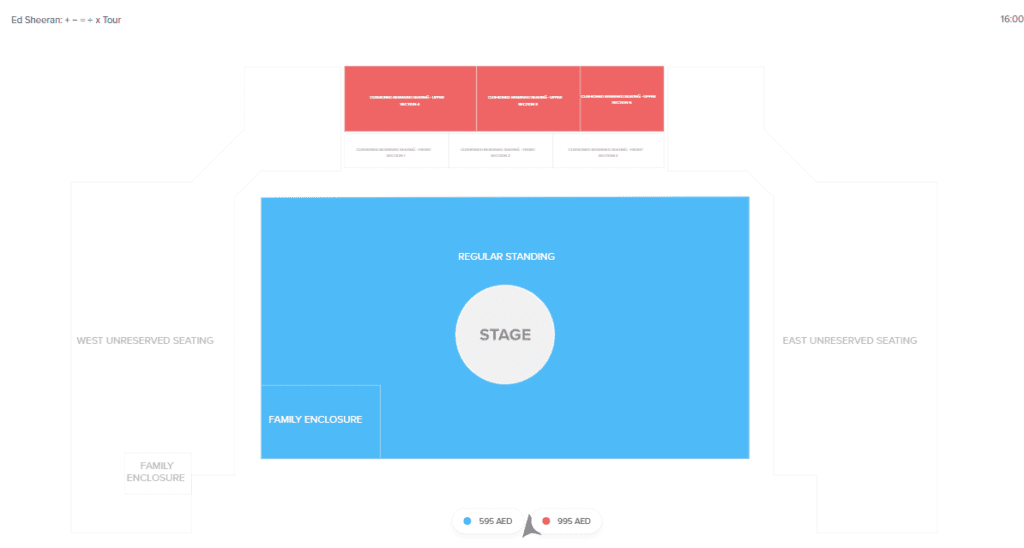

But before we start booking flights and racking up digital surfboards, let’s dive into the details. Here are 10 UAE credit cards offering sweet EMI options, each with its own set of perks and quirks :

10 Budget friendly EMI credit cards in UAE (Dubai)

1.FAB Classic Credit Card

Annual Fee – AED 250

This pocket-friendly gem lets you split purchases from AED 3,000 into EMIs, perfect for unexpected (but necessary) expenses like car repairs or that leaky roof. No judgment here, leaky roofs happen!

2. Mashreq Neo Visa Signature Credit Card

Annual Fee– AED 899

Treat yourself to a shopping spree without the guilt! This card offers 0% interest EMIs on select electronics and furniture stores, along with travel insurance and purchase protection. Now, go forth and conquer those sale racks!

3. Standard Chartered Platinum Rewards Visa Credit Card

Annual Fee -AED700

This travel enthusiast’s dream card lets you split flight and hotel bookings into EMIs, plus you earn reward points on every swipe. Double the adventure, double the joy!

4. RAKBANK Smart Traveller Credit Card

Annual Fee -AED 350

Say goodbye to airport stress! This card offers priority check-in, lounge access, and yes, you guessed it, EMIs on flight bookings. Now, boarding time becomes “relaxation time.” No more sprinting through duty-free with your hair on fire!

5. Emirates Islamic Flex Everyday Credit Card

Annual Fee : AED 250

This everyday hero lets you split purchases from AED 500 into EMIs, covering everything from groceries to that new outfit you need for (ahem) post-vacation Instagram pics. We all deserve a post-trip fashion update, right?

6. HSBC Premier Mastercard Credit Card

Annual Fee– AED 1,500

Spoil yourself with 0% interest EMIs on luxury brands and designer boutiques, access to prestigious airport lounges, and complimentary travel insurance.

7. ADCB Elite Credit Card

Annual Fee-AED 3,000

Bask in VIP treatment with dedicated concierge service, exclusive dining and entertainment offers, and up to 60 months’ EMI options on high-end purchases.

8. First Abu Dhabi Bank World Elite Mastercard Credit Card

Annual Fee-AED 1,500

Extend your gadget addiction with 0% interest EMIs on electronics and appliances, plus global Wi-Fi access and extended warranties.

9. Emirates Skywards Platinum Credit Card

Annual Fee– AED 1,250

Transform business trips into tech-fueled adventures with EMIs on gadgets and electronics at select airport stores, along with priority check-in and bonus Skywards Miles.

10. RAKBank Smart Shopper Credit Card

Annual Fee– AED 500

Manage family expenses like a pro with EMIs on groceries and utility bills, enjoy family-friendly travel insurance, and earn reward points on everyday purchases

Remember, friends, EMI cards are powerful tools, but like any magic, they require responsible use. Always be mindful of interest rates (which can vary) and stick to a budget.

Don’t let the siren song of endless installments lure you into a financial whirlpool. Think of it as spreading out the fun, not drowning in debt.

Below are some secret tips which I have encountered in my usage and come to know for various users and they actually saves a lot for you.

Bonus Tips Only for you

Minimum transaction amount for EMI eligibility : Some cards have a minimum amount you need to spend before you can split it into payments.

Maximum tenure for EMI repayment : This can range from a few months to a few years, so choose a card with a timeline that fits your budget.

Buy now ,Pay Later : Check for cards offering “buy now, pay later” schemes on specific platforms like Amazon or Noon, allowing you to split purchases into installments without a traditional credit card.

Interest EMI : Look for cards with 0% interest EMI offers on specific categories like travel or electronics. Score yourself a sweet deal without the sting of extra charges! Because who doesn’t love a bargain with their new surfboard?

Additional benefits : Go beyond just EMI options and highlight other perks like cashback, reward points, travel insurance, airport lounge access, etc.

Link to the card’s website for more details : Make it easy for readers to get all the nitty-gritty information.

Remember, finding the perfect EMI card is all about tailoring it to your unique lifestyle and spending habits. Don’t be afraid to shop around and compare offers before making a decision!

Overall, EMI credit cards can be a helpful tool for managing large purchases and making them more affordable, but it’s important to use them responsibly and understand the associated fees and interest rates.

I hope this EMI Credit card guide in Uae will help you out in many ways and you can bookmak this article for cross check while choosing or selecting Low cost budget friendly EMI credit cards option in dubai.

Until Then ,

Remember,

Always spend responsibly !

Stay Safe and Financially Healthy.

Disclaimer : This above article blog post is for educational and informational purposes only.We do not recommend,prefer or promote any type of financial instruments.We are not responsible for your choices,Do your own research before choosing any products.