A guide to Top 15 Loan apps in Uae to get instant cash online with their features and services to get instant cash credited to your account with minimal procedures.

Need Some Instant cash ? You are in the right place to know about it.

The UAE is a country with a growing economy and a young population. This has led to a demand for personal loans, and there are now a number of loan apps available in the country.

These apps offer a convenient and quick way to borrow money, and they can be a lifesaver in times of need.

How to Choose the Right Loan App in UAE

When choosing a Online loan app in Uae, it is important to consider your needs and requirements. Some factors to consider include the amount of money you need, repayment terms, interest rate, and fees.

It is also important to check the app’s terms and conditions carefully before you apply.

If you have good credit, you may be able to get a lower interest rate from a bank or credit union. However, if you have bad credit, you may need to use a loan app.

Instant Cash Loan apps can be a good option if you need money quickly and easily. However, it is important to be aware of the risks involved in taking out a loan.

In today’s fast-paced world, convenience is key, and that extends to our financial needs as well. If you’re in the UAE and looking for quick and hassle-free access to loans, loan apps can be a game-changer.

These apps provide a seamless borrowing experience, allowing you to apply for loans right from your smartphone.

In this article, we’ll explore 15 lending apps in UAE, highlighting their features, requirements, and fees, to help you make an informed decision.

15 Online Loan Lending Apps In UAE (Dubai & Abu Dhabi)

Here is a list of 15 Online credit loan apps in the UAE, along with their features, requirements, and fees:

1.Cash Now

CASHNOW is a mobile app that offers personal loans to UAE residents. The app is easy to use and can be accessed from anywhere.

CashNow offers instant Aed 5000 to AED 50,000 loans instantly with repayment terms of up to 36 months.

2. E& Money

E& Money is another mobile app that offers personal loans to UAE residents.

Approved by Central bank of UAE,they are expanding their financial reach to customers so you can get better rates.Don’t forget to bargain for better rates.

3. Lnddo

Lnddo is a mobile app that offers personal loans to UAE residents with bad credit.

- First Licensed Direct Digital Lender in UAE & Mena Region.

- short term loans for small businesses.

- Funding upto USD 100,000

- Zero collateral

- Quick online application

- Instant pre-approval

- Flexible repayment

- Funds credited within days

4. MishiPay

Mishi pay is a mobile app that offers personal loans to UAE residents with no credit check. MishiPay is the most expensive loan app on this list, but it is also the easiest to get approved for.

MishiPay offers loans up to AED 10,000 with repayment terms of up to 6 months. The interest rate on MishiPay loans is 40% per year.

Note : Choose Wisely (Do your own research)

5 . Cura

Cura is a mobile app that offers personal loans to UAE residents with good credit. Cura offers lower interest rates than other loan apps, but it is also more strict with its requirements.

Cura offers loans up to AED 50,000 with repayment terms of up to 36 months. The interest rate on Cura loans is 15% per year.

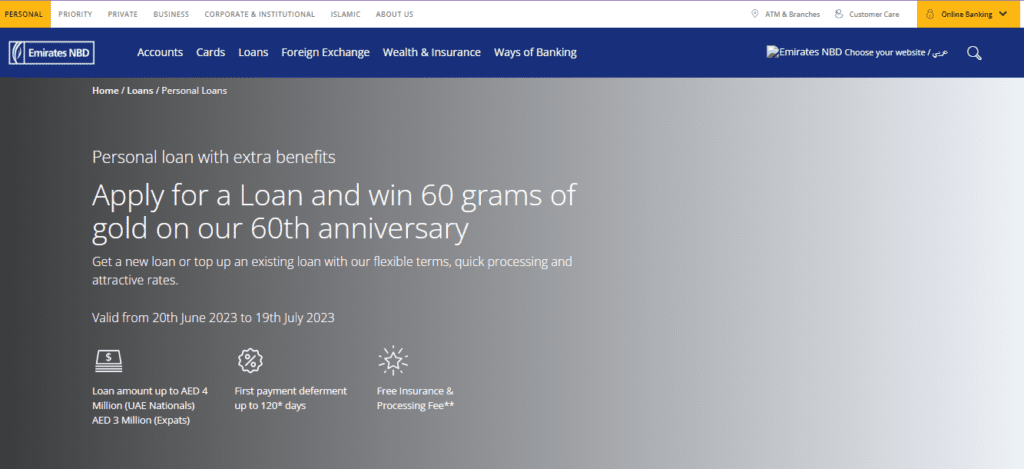

6. Emirates NBD Personal Loan

Emirates NBD Personal Loan is a personal loan offered by Emirates NBD, one of the largest banks in the UAE.

Emirates NBD Personal Loan offers loans up to AED 500,000 with repayment terms of up to 60 months. The interest rate on Emirates NBD Personal Loan is 12% per year.

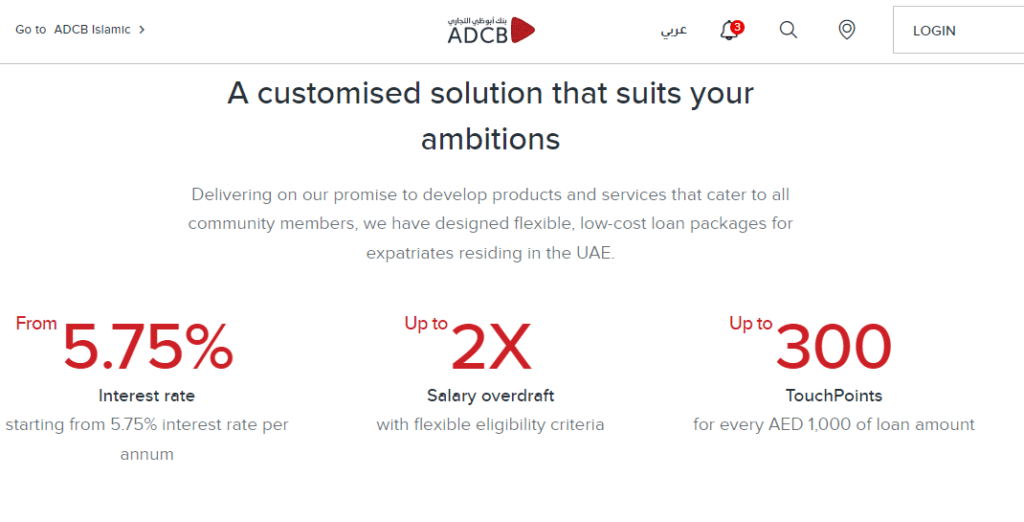

7. ADCB

ADCB Personal Loan is a personal loan offered by ADCB, another large bank in the UAE.

ADCB Personal Loan offers loans up to AED 500,000 with repayment terms of up to 60 months. The interest rate on ADCB Personal Loan is 13% per year.

8. First Gulf Bank

First Gulf Bank Personal Loan is a personal loan offered by First Gulf Bank, a leading bank in the UAE.

First Gulf Bank Personal Loan offers loans up to AED 500,000 with repayment terms of up to 60 months. The interest rate on First Gulf Bank Personal Loan is 14% per year.

9. Abu Dhabi Islamic Bank

Abu Dhabi Islamic Bank Personal Loan is a personal loan offered by Abu Dhabi Islamic Bank, a leading Islamic bank in the UAE. Abu Dhabi Islamic Bank Personal Loan offers loans up to AED 500,000 with repayment terms of up to 60 months. The interest rate on Abu Dhabi Islamic Bank Personal Loan is 11% per year.

10 . RAKBANK Personal Loan

11. Mashreq Neo

Mashreq Neo Personal Loan is a personal loan offered by Mashreq Bank, one of the oldest and largest banks in the UAE.

Mashreq Neo Personal Loan offers loans up to AED 500,000 with repayment terms of up to 60 months. The interest rate on Mashreq Neo Personal Loan is 12% per year.

Read this also :

12 . Commercial Bank of Dubai (CBD)

CBD Personal Loan is a personal loan offered by CBD, a leading bank in the UAE.

Quick loan upto Aed 150000 approved instantly through CBD app.

CBD Personal Loan also offers loans up to AED 500,000 with repayment terms of up to 60 months. The interest rate on CBD Personal Loan is 13% per year.

13 . Al Rajhi Bank

AL Rajhi Personal Loan is a personal loan offered by Al Rajhi Bank, a leading Islamic bank in the UAE. Al Rajhi Bank Personal Loan offers loans up to AED 500,000 with repayment terms of up to 60 months. The interest rate on Al Rajhi Bank Personal Loan is 10% per year.

14. Etihad Credit Union

Etihad Credit Union Personal Loan is a personal loan offered by Etihad Credit Union, a leading credit union in the UAE.

Etihad Credit Union Personal Loan offers loans up to AED 200,000 with repayment terms of up to 48 months. The interest rate on Etihad Credit Union Personal Loan is 11% per year.

15 . Liv

Liv Personal Loan is a personal loan offered by Liv, a digital bank in the UAE. Liv Personal Loan offers loans up to AED 25,000 with repayment terms of up to 24 months.

The interest rate on Liv Personal Loan is 12% per year.

Let us also guide you in what is it needed to choose a better instant cash loan app in Uae for your personal financial use.We have listed some points below which will help you in sorting down and compare the best option for you.

Read More : How to apply Loan in UAE without Emirates ID Card

13 Best Personal loan for expats with low income in Uae

8 Points to Remember Before using Instant Cash Loan App in UAE

1.Verify the Legitimacy of the App :

- Only use loan apps registered with the Central Bank of the UAE (CBU).

- Check the CBU’s website for a list of licensed lenders.

- Avoid apps with unlicensed lenders, as they may operate illegally and charge exorbitant fees.

Note : There are many fake lenders who are available online,protect yourself from them.It is your responsibilty to choose the genuine resources.

2. Understand Your Eligibility:

- Each app has different eligibility criteria, such as minimum salary, employment status, and residency.

- Check the app’s terms and conditions before applying to ensure you meet the requirements.

3. Compare Loan Options :

- Different apps offer various loan amounts, interest rates, and repayment terms.

- Compare options to find the most affordable and suitable loan for your needs.

4. Be Transparent about Your Income :

- Provide accurate information about your income and expenses during the application process.

- Misrepresenting your financial situation can lead to loan rejection or legal trouble.

5. Review Fees and Charges :

- Understand all fees associated with the loan, such as origination fees, late payment fees, and processing charges.

- Look for apps with transparent fee structures and avoid hidden costs.

6. Borrow Responsibly :

- Only borrow what you can comfortably afford to repay.

- Consider your existing financial obligations before taking on additional debt.

7. Make Repayments on Time :

- Timely repayments are crucial for maintaining a good credit score and avoiding late payment penalties.

- Set up automatic payments or reminders to ensure you don’t miss a deadline.

8. Seek Help if Needed :

If you struggle with managing your finances or repaying your loan, seek help from financial advisors or government-approved debt relief agencies.

Remember, using instant loan apps should be a last resort. Always explore alternative options like budgeting, saving, or seeking financial assistance from family or friends before taking on debt.

By following these tips and staying informed about UAE regulations, you can use instant cash loan apps safely and responsibly.

Final Words

Loan apps can be a convenient way to borrow money, but it is important to compare your options carefully before you apply.

Consider your needs and requirements, and compare the interest rates, fees, and terms of different loan apps. By doing your research, you can find the best loan app for your needs.

NOTE : It might look very luring to get high amount of money approved instantly ,but remember if it exceeds your plans than it might cause you harm in your financial stability.Never take more than you need for emergency.

We hope this blog article will help you in any way and you will choose and make a right decision in choosing the instant cash loan app in UAE.

Until then,

See you on the other side with more relevant information and guides for you .

Stay Safe and Healthy !

Frequently Asked Questions (FAQ’s)

Is it safe to borrow money from digital lenders in uae ?

Yes , but please do check the authorized license holder form UAE governemnt before applying for loan on any loan apps or lenders in uae.

Can I borrow loan without Emirates Id in Uae ?

No ,You need to have local identification ID which is Emirates Id for loan approval in UAE.

Which loan app is better in uae ?

It totally depends on your needs and services provided for your convenience in Uae

Can I get Loan in dubai ?

Yes,approach any authorized lender with your needs like Emirates Nbd,Adcb Bank,etc and submit your documents ,it will approved in minimal time.