A detailed full guide on 15 reasons you need a budget to live in dubai (UAE) with full explaination fo dubai lifetsyle.

Dubai is a city of contrasts, with a high cost of living and a wide range of lifestyles. Whether you’re a high-flying expat or a budget-conscious backpacker, it’s important to have a budget in place if you want to live comfortably in Dubai.

Living in Dubai offers a luxurious and vibrant lifestyle with its gleaming skyscrapers, cultural diversity, and endless opportunities. However, to fully embrace the Dubai lifestyle, it is essential to have a well-planned budget.

A budget is a roadmap to financial stability, enabling residents to manage expenses, save for the future, and enjoy the city’s offerings without stress.

In this article, we will explore 15 compelling reasons why having a budget is crucial for anyone residing in Dubai, along with practical examples illustrating the significance of budgeting in the context of the city’s unique lifestyle.

Understanding the Dubai Lifestyle

Dubai’s lifestyle is characterized by extravagance, world-class entertainment, and modern living. Residents have access to top-notch amenities, entertainment venues, and a bustling social scene. However, this upscale lifestyle comes with its own set of financial challenges.

Importance of Budgeting in Dubai

3.1 Managing Living Expenses

Dubai’s high cost of living necessitates effective budgeting to cover basic necessities like housing, transportation, and utilities. A well-structured budget ensures that these expenses are managed efficiently, leaving room for savings and discretionary spending.

3.2 Planning for Luxuries

Living in Dubai opens up opportunities for luxurious experiences, such as dining at gourmet restaurants, enjoying premium shopping, and attending extravagant events. Budgeting helps individuals allocate funds for these indulgences without overspending.

3.3 Saving for the Future

Amidst the allure of the present, it is crucial to plan for the future. A budget facilitates systematic saving and investing, providing financial security for retirement and other long-term goals.

Here are 15 reasons why you need a budget to live in Dubai:

1.Cost of Rent in dubai is high

The average rent for a one-bedroom apartment in Dubai is around AED 5,000 per month. If you want to live in a more central location, the rent will be even higher.

2. Cost of Transportation in dubai is high

The cost of taxis and public transportation in Dubai is also high. A single taxi ride can cost AED 20 or more, and a monthly pass for public transportation costs around AED 500.

3. Cost of Food in dubai is high

Eating out in Dubai can be very expensive. A meal at a mid-range restaurant can cost AED 100 or more, and a meal at a high-end restaurant can cost even more.

4. Cost of Entertainment is high

Going to the movies, the club, or the mall can be very expensive in Dubai. A movie ticket costs around AED 50, and a night out at the club can cost AED 1000 or more.

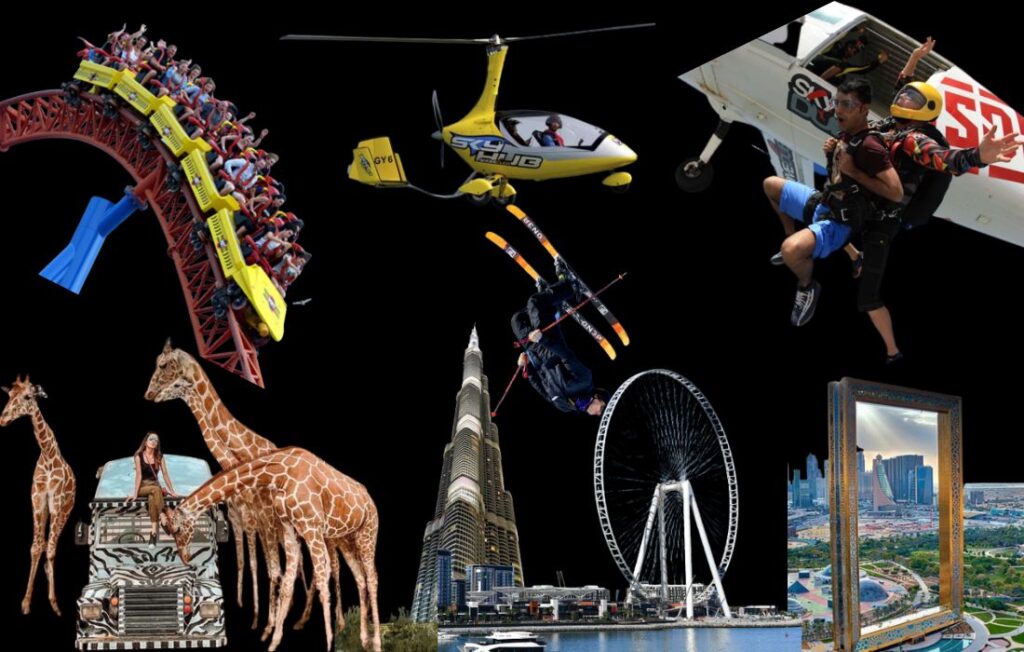

5. Cost of activities in dubai is high

If you enjoy activities like golfing, skiing, or skydiving, you’ll be in for a shock when you see the prices in Dubai. A round of golf can cost AED 1000, a day of skiing can cost AED 500, and a skydive can cost AED 2000.

6. Cost of shopping in dubai is high

Dubai is a shopper’s paradise, but it’s also a very expensive place to shop. A designer handbag can cost AED 10,000, and a pair of high-end shoes can cost AED 5000.

7. Cost of healthcare in dubai is high

If you need medical attention in Dubai, you’ll be paying top dollar. A consultation with a doctor can cost AED 500, and a hospital stay can cost AED 10,000 or more.

8. Cost of education in dubai is high

If you have children, you’ll need to factor in the cost of education when creating your budget. Private school tuition in Dubai can cost AED 50,000 per year or more.

9. Cost of utilities is high

The cost of electricity, water, and gas is also high in Dubai. Your utility bills could easily add up to AED 1000 per month or more.

10. Cost of transportation is high

If you have a car, you’ll need to factor in the cost of petrol, parking, and insurance. Petrol in Dubai is one of the most expensive in the world, and parking can be very expensive in some areas.

11. Cost of socializing is high

If you like to go out and socialize, you’ll need to factor in the cost of drinks, food, and entertainment. A night out on the town could easily set you back AED 1000 or more.

12. Cost of travel is high

If you want to travel within the UAE or to other countries, you’ll need to factor in the cost of flights, hotels, and activities. Flights within the UAE can be expensive, and hotels in popular tourist destinations can be very expensive.

13. Cost of visa and work permit fees is high

If you’re not a UAE citizen, you’ll need to pay visa and work permit fees. These fees can be several thousand dollars.

14. Cost of unexpected expenses is high

Things like medical emergencies, car accidents, and theft can happen anywhere, and they can be very expensive to deal with in Dubai.

15. Unusual temptations

It’s easy to get caught up in the Dubai lifestyle and forget about your budget. The city is full of temptation, so it’s important to stay focused on your financial goals.

Read this also : 21 ways How Womens in Dubai can save more money

75 Profitable low investment Business ideas in dubai 2023

25 ways to earn money online in dubai,UAE

How budget will help you in dubai

- Having a budget will help you save money. This can be used for a rainy day, a vacation, or your future retirement.

- Having a budget will help you make better financial decisions : When you know how much money you have to spend, you’re less likely to make impulse purchases.

- Having a budget will help you stay out of debt : If you’re spending more money than you earn, you’re setting yourself up for debt problems.

- Having a budget will help you achieve your financial goals : Whether you’re saving for a house, a car, or retirement, having a budget will help you stay on track.

- Having a budget will give you peace of mind : Knowing that you’re on top of your finances can help you relax and enjoy your life in Dubai.

- Having a budget will help you build a better future for yourself and your family : When you’re financially secure, you’re better able to provide for your loved ones.

- Having a budget will help you set a good example for your children : If you want your children to learn good financial habits, it’s important to model those habits yourself.

- Having a budget will make you a more responsible adult : When you’re responsible with your money, you’re showing that you’re responsible with other aspects of your life.

Tips for Creating a Successful Budget

Track Your Expenses: Monitor your spending to identify areas where you can cut back.

Set Realistic Goals: Define achievable financial objectives and plan your budget accordingly.

Prioritize Saving: Allocate a portion of your income to savings and investments.

Be Prepared for Emergencies: Set up an emergency fund to handle unexpected financial challenges.

Review and Adjust: Regularly evaluate your budget and make adjustments as needed.

Living in Dubai offers a captivating and extravagant lifestyle, but it comes with financial responsibilities. Creating and maintaining a budget is the key to embracing the Dubai lifestyle without compromising on financial security and peace of mind.

Frequently Asked Question (FAQs)

Is budgeting only necessary for high-income individuals in Dubai ?

Budgeting is essential for everyone, regardless of income level. It helps manage expenses effectively and plan for the future.

Can budgeting enhance my Dubai experience ?

Absolutely! Budgeting allows you to strike a balance between enjoying the city’s offerings and maintaining financial stability.

How do I start budgeting if I’m new to Dubai ?

Begin by analyzing your income and expenses, then set specific financial goals and allocate funds accordingly.

Does budgeting mean giving up on luxuries in Dubai ?

Not at all. Budgeting allows you to indulge in luxuries responsibly, ensuring that you can enjoy them without financial strain.

Can budgeting help me save for long-term goals ?

Yes, budgeting encourages systematic saving, making it easier to achieve long-term financial objectives.