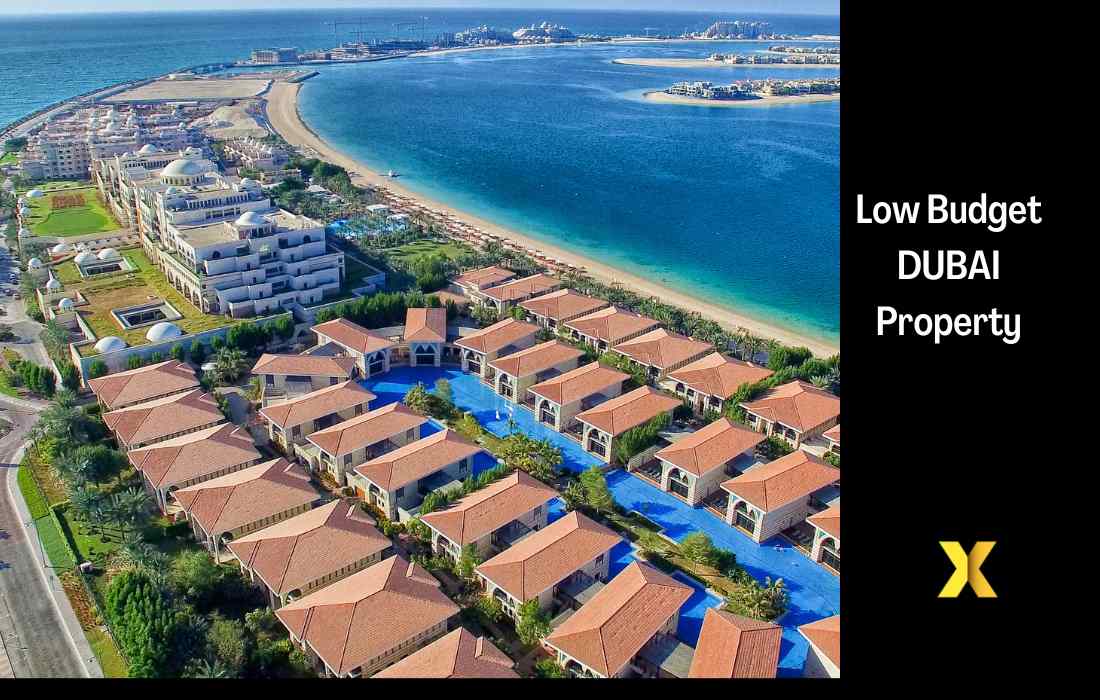

Investing in UAE : Here,we will discuss on how to invest in dubai property with low budget portfolio with step by step procedure to attain real estate in UAE.

Dubai. Glittering skyscrapers, desert adventures, and a thriving economy.

It’s a city that screams luxury, but what if I told you even budget-conscious dreamers can own a piece of it ?

Low Budget Property Investment in dubai isn’t just a mirage; it’s a reality with the right approach.

So, grab your sunblock and let’s explore!

Complete step By step guide to Invest in Dubai Property with Less Money (Low Budget)

8 steps guide to invest in Dubai Property with low budget or less money as follows :

Step 1: Define Your “Low” Budget & Set with detailed specifications .

Before diving in, understand what “low” means for you. Is it AED 200,000 or AED 500,000? Knowing your limit helps navigate the vast Dubai property landscape.

Think of your budget as your trusty camel in the desert – don’t overload it. Be realistic about your savings and consider all hidden costs like registration fees, service charges, and potential renovations. Aim for a property that leaves you breathing room, not gasping for air.

Step 2: Research,Compare & Target Affordable Areas through online platforms

Dubai isn’t just beaches and Burj Khalifas. Venture beyond the glitz and explore up-and-coming areas like Jumeirah Village Circle (JVC), Dubai Silicon Oasis (DSO), or International City. These areas offer modern apartments and studios at much friendlier prices, often with good rental yields.

After setting price standards for yourself ,You can start reserching ,comparing the prices on online platform like Bayut properties,property finder,dubizzle ,etc.

This will give you idea about the market rates for particular location.

Step 3 : Off -Plan or Ready made ,choose One after considering your risks.

Buying property before it’s built, aka “off-plan,” can be cheaper. Developers often offer attractive payment plans and discounts, making your budget stretch further.

Off-plan : Pre-construction properties offer attractive discounts, perfect for long-term investors. Just be prepared for potential delays and developer risk.

Ready-made : Move in, rent out, and reap the rewards ASAP. These come at a premium, but offer immediate income and tangible ownership.

However, be cautious: choose established developers with proven track records.

Step 4: Utilise Fractional Ownership with new platforms available.

Think “sharing is caring.” Platforms like SmartCrowd ,Stake,etc. allow you to co-own a property with others, lowering the entry barrier significantly. Imagine owning a piece of a beachfront apartment for a fraction of the price!

Step 5 : Now decide your financing options/Mortgages and Get ready.

Mortgages can be your best friend. Research loan options from UAE banks, considering factors like

-Interest rates

-Repayment terms

-Loan to value ratios

-Hidden fees & Many More.

A financial advisor can help navigate the mortgage maze.

Unless you’re Aladdin with a magic lamp, financing is likely your chariot to property ownership. Compare mortgage options from various banks, considering interest rates, loan-to-value ratios, and hidden fees. Remember, a pre-approved mortgage can give you an edge in negotiations.

Step 6: Seek the Licensed/experienced Expert Guidance

Don’t navigate the desert alone ! Partner with a reputable real estate agent who understands the Dubai market and your budget constraints. They can unearth hidden gems, negotiate deals, and guide you through the legal process.

A good real estate agent can be your oasis of knowledge. They’ll understand your budget, recommend suitable areas, and negotiate the best deals. Choose someone licensed, experienced, and preferably speaking your language.

Step 7 : Befriend the Numbers : Budget, Research, and Repeat

Investing in any property, even with a low budget, requires careful planning. Research property prices, rental yields, and potential costs like maintenance and service charges.

Don’t be afraid to negotiate! Compare different options, crunch the numbers, and create a realistic budget. Remember, knowledge is power, and a well-informed investor is a confident one.

Step 8 : Be Patient and Realistic

Rome wasn’t built in a day, and neither is your Dubai property portfolio. Be patient, do your research, and avoid impulsive decisions. Remember, investing is a marathon, not a sprint.

Remember, investing in Dubai real estate, even on a budget, is a marathon, not a desert sprint. Approach it with realistic expectations, smart planning, and a touch of adventurous spirit. And who knows, your Dubai dream palace might just rise from the sandy horizon, gleaming under the Arabian sun.

Points to Remember while buying property in dubai

- Low budget doesn’t mean low returns. With the right approach, you can still achieve your investment goals in Dubai.

2. Think outside the box. Explore alternative options like off-plan purchases or fractional ownership.

3. Do your research and seek expert advice. Knowledge is your best weapon in the property game.

So, are you ready to embark on your Dubai property adventure ?

Bonus Tip

1.Seek Expert Guidance.

2. Patience is your compass! Dubai’s property market is dynamic. Don’t rush into the first shiny mirage. Do your research, compare options, and wait for the right opportunity to bloom.

3. Think beyond apartments. Consider studios or townhouses for better rental yields.

4. Factor in maintenance fees. They can add up, so choose properties with manageable costs.

5. Rent it out! Dubai has a thriving rental market. Maximize your investment by finding reliable tenants.

Read More :

With a bit of planning, research, and a dash of desert spirit, you can conquer the market and make your investment dreams a reality. Now go forth, explore, and remember, even in the land of luxury, there’s always a treasure waiting to be discovered.

Disclaimer : This article is for informational purposes only and should not be considered financial advice. Always consult with a qualified professional before making any investment decisions.

EDITOR

Frequently Asked Questions (Faq’s)

How much do I really need to invest ?

It depends! Budget around 10-20% of your property price for upfront costs like registration fees, down payments, and agency fees. Aim for a property that leaves room for monthly maintenance and potential renovations without straining your finances.

Are off-plan properties risky for budget investors ?

Yes, there’s a higher risk with off-plan purchases. Construction delays and developer issues can happen. However, the potential discounts can be significant, especially in up-and-coming areas. Weigh the risks and rewards carefully before diving in.

What are some good budget-friendly areas in Dubai ?

Jumeirah Village Circle (JVC), Dubai Silicon Oasis (DSO), International City, and Dubailand offer modern apartments and studios at attractive prices. They also have good rental potential, making them ideal for buy-to-let investors.

Can I get a mortgage with a limited budget ?

Absolutely! Many banks in Dubai offer mortgage options for budget-conscious investors. Compare interest rates, loan-to-value ratios, and hidden fees before choosing your loan provider. Getting pre-approved can give you an edge in negotiations.

What are some hidden costs I should be aware of ?

Don’t forget about maintenance! Budget for potential repairs, service charges, and utility bills. Factor these into your rental calculations to avoid financial surprises down the road.